Hidden Money: Tips for Taking Advantage of the R&D Tax Credit

As companies across the U.S. lean into domestic innovation and technological advances to allow them to stand out amongst competitors, it is increasingly critical to find revenue savings to ensure long-term viability and profitability. As one of the country’s largest tax incentive, the federal research and development (R&D) tax credit can be a crucial piece of a forward-looking economic plan for startups and established businesses alike. But as with all government regulated programs, it is vital to understand what R&D tax credit is all about, how it can impact your business and what to look for in your tax practitioner.

Essentially, the R&D tax credit was created and designed to encourage innovation and allow companies to receive money back for work that they’re already doing. Many businesses are eligible for the R&D tax credit but don’t realize it. Examples of industries that often qualify include software, biotech, manufacturing, and more. Taking full advantage of the R&D tax credit can mean an increase in cash flow and a decrease in effective tax rate.

Although the R&D tax credit has been in place since 1981, it didn’t become a permanent provision until 2015 with the passage of the PATH Act. Not only did this make the R&D tax credit permanent, but prior to 2015, many startups didn’t take the R&D credit because companies could only take it against income tax, and startups generally don’t have income. The PATH Act allowed companies to take the credit against their payroll tax, so businesses did not need revenue to benefit from the credit—they just needed to hire people. This essentially infused billions of dollars in non-dilutive capital into the system, but many companies remained unaware. The recent Inflation Reduction Act has made the R&D tax incentive even more valuable by doubling the credit, such that beginning with the 2023 tax year startups/young companies with less than $5 million in gross receipts can use the R&D tax credit to offset payroll taxes up to $500,000 per year.

In 2020, according to Tax Foundation, $11.8 billion was claimed in R&D tax credits. That means so many companies are continuing to innovate, using their R&D tax credits to reinvest into their businesses to grow and scale. But there are billions more unclaimed likely due to a combination of perceived complexity, audit concerns, and common misconceptions about applicability to a company’s operations.

It is worth noting that small and medium-size businesses (SMBs) often can benefit from R&D credits but only make up a small portion of the businesses actually utilizing those credits. With a combination of education and collaboration, SMBs may be able to take full advantage of these valuable R&D credits.

Complexities Made Simple

One of the most misunderstood pieces of the R&D tax credit program is who qualifies and how. Many startups that aren’t in scientific or technical industries may assume they don’t qualify. In reality, activities in a wide range of industries can generate qualifying R&D expenditures. These categories might include cosmetics, food and beverage, apparel, telecommunications, and more.

Essentially, businesses considering filing an R&D claim must meet four criteria:

1. Qualified Purpose: Are you developing or improving a product, process, formula, or software?

2. Eliminate Uncertainty: Are you asking questions like, “Can we develop it?” or “How do we develop it?”

3. Process of Experimentation: Are you systematically evaluating one or more alternatives?

4. Technological in Nature: Is your work within physical or biological sciences, engineering, or computer sciences?

Chances are, if your company is doing something innovative, that activity and associated expenses may likely qualify for the R&D tax credit.

Another added layer of complexity comes thanks to amortization. As of 2022, the Tax Cuts and Job Act requires businesses amortize their R&D costs over five years, instead of deducting them immediately, according to the Tax Foundation. This doesn’t change the way a company would qualify for, or file for, the claim, it only impacts the company’s application of the credit. But because it can impact the capital return, tax experts at TriNet’s Clarus R+D can help SMBs navigate the entire process.

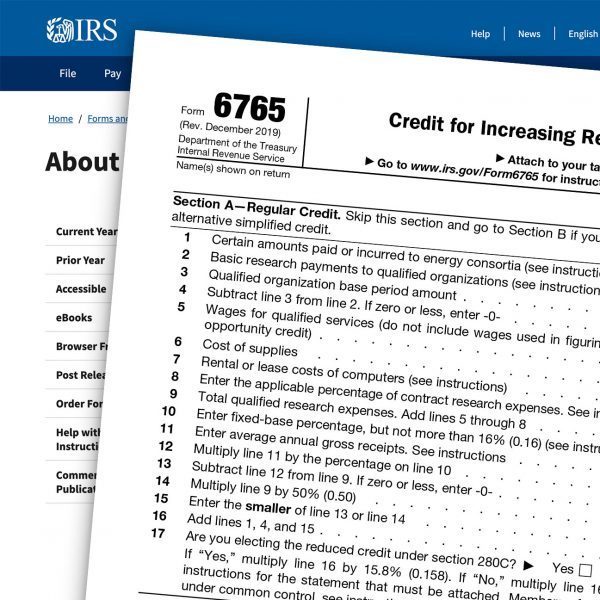

Avoiding The “A” Word: Audit

Working with a respected service provider may be the best way for businesses to ensure they are compliant and to help mitigate the risk of an IRS audit when filing comprehensive R&D claims. Some of the factors to consider when choosing a service provider for R&D tax credit claims include:

- Finding a service provider with R&D credit experience

Service providers with extensive R&D experience are necessary to ensure a smooth R&D study process. Without extensive knowledge of required documentation and nuances in the tax code associated with this credit, you may be left vulnerable to an IRS audit. Unfortunately, the IRS has vague guidelines on what constitutes sufficient documentation to claim the R&D tax credit. And, as with most IRS matters, the burden of proof is with the taxpayer. A good rule of thumb is to hold on to all documentation relating to your R&D activities in the event of an audit.

- Transparency is key

Be sure to have a thorough understanding of your provider’s fee structure and contingencies. Make sure the professionals you are working with have a reasonable capped rate, and look for the pros who will tier their rate based on the size/volume of your studies. You should also ask questions about success rate and numbers of audits.

- Accessibility, visibility and collaboration

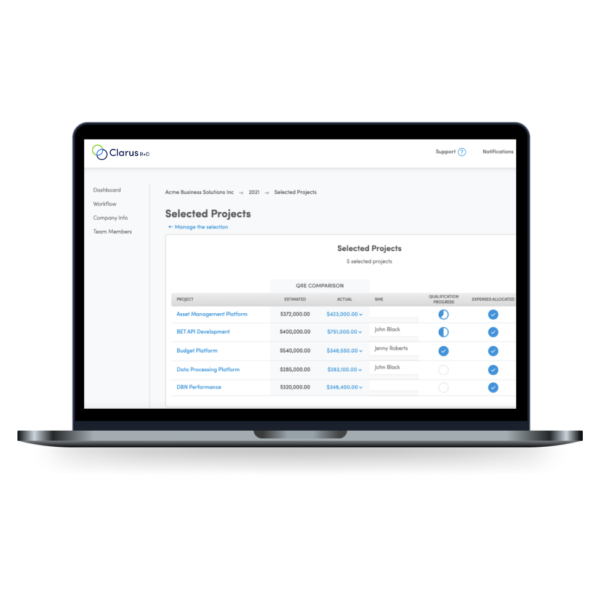

Ensure that you can access and see the process behind your R&D studies regardless of whether your service provider is using pen to paper or advanced software designed to optimize R&D tax credits. Collaboration is also vital. Your input in the study is critical since the details around the process of developing your company’s technology are needed to support an audit that could come three years down the road. Your provider should look for your input in the study but make the process simple and efficient.

Another key factor is having a system in place that understands and aligns with IRS audit process. Teaming up with a provider that offers advanced software and a team of skilled CPAs can deliver the assurance and confidence needed to take advantage of the R&D credits that go unclaimed each year.

The United States relies on innovation woven throughout all industries. Whether a business is a small startup or an established enterprise, the R&D tax credit exists to further propel the kinds of cutting edge thinking that consumers worldwide depend upon. If it is uncharted territory for now, it doesn’t have to stay that way. By partnering with a respected and knowledgeable R&D service provider, a company can reap the rewards of one of America’s largest tax incentive with minimal risk of audit. It’s never been a better time to start enjoying increased cash flow for long-term business stability, viability and growth.

Share

ABOUT CLARUS R+DWith custom software backed by a team of tax experts, Clarus R+D specializes in tax credits for growth businesses. Our technology-driven solution simplifies the process, maximizes benefit, and ensures compliance. We partner with accounting firms, financial advisors, investors, payroll providers, and more.